Indices Trading

An index is most regularly defined as a portfolio of stocks that represents a particular market or market sector. Thus CFD indices measure the price performance of a group of stocks in a specific section of the stock market.

Trading

indices enable you to get exposure to an entire sector by opening a single position.

Indices price movements and volatility are impacted by a range of factors like

political events, major events that affect companies in a particular sector,

economic data like employment figures, and big changes in the currencies

markets.

Trade movements in indices

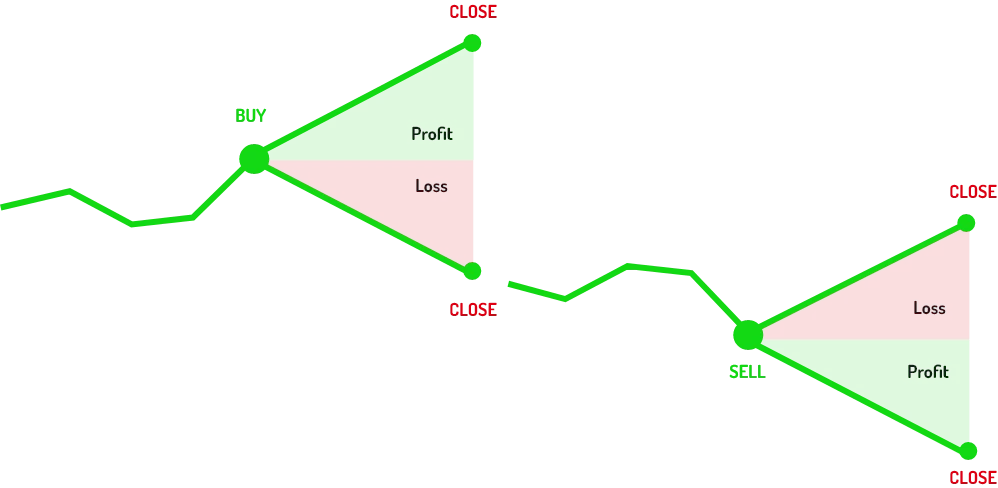

How Index trading works?

Thousands of companies issue shares traded on the stock market. These companies can be subdivided into several categories, based on industry, region or exchange they are traded on. A number of financial agencies calculate indices based on the stock prices in order to evaluate the performance of the market.

We Execute and Provide the Best Liquidity

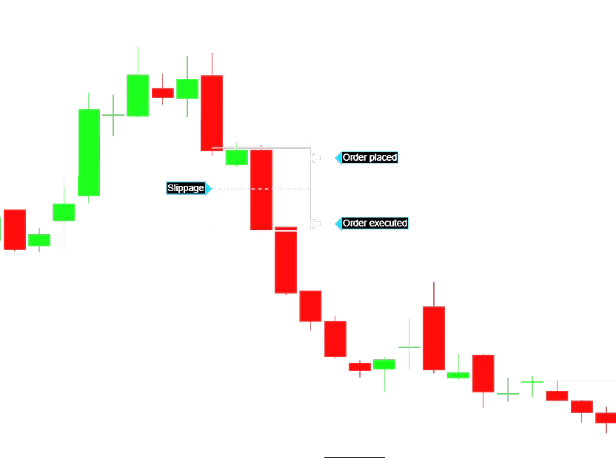

Slippage

We aim to provide the best trading execution available to clients to fill all orders at the requested price.

STP

We employ “Straight Through Processing” (STP), passing on clients’ trades directly to our tier-one liquidity providers.

Market Execution

We offer the best liquidity with the lowest latency connection to our tier-one liquidity partners. All trades at X are executed directly with the market conditions without requotes.

New to Indices trading?

You may be interested in:

More Products, More Choices, Expanding Every Day!

Enter the world of trading and benefit from immediate access to over 200 trading instruments from 5 asset classes available on one single trading platform. Take positions on hundreds of CFD assets, including forex, shares, metals, futures, commodities, and indices. Trade with the tightest spreads, best pricing, and fast execution.